Combining the Ascending Triangle Chart Pattern with the Smart Money Concept (SMC) for Better Trading Accuracy

When it comes to trading in the forex market, one of the simplest yet most powerful chart patterns you’ll come across is the Ascending Triangle. This pattern is easy to identify, beginner-friendly, and highly effective in spotting trend continuation setups. But while it’s simple, trading it blindly can lead to false breakouts and stop-loss hunts. That’s why combining the Ascending Triangle with Smart Money Concept (SMC) entry models such as ICT Breakaway Gaps, Fair Value Gaps (FVGs), Order Blocks, and Liquidity Sweeps is the real game-changer.

In this guide, we will break everything down in a clear, step-by-step manner so that you, as a beginner trader, can understand how to spot the Ascending Triangle, trade the breakout and retest, and apply institutional concepts to enter with confidence.

Why the Ascending Triangle Chart Pattern Works

The Ascending Triangle is powerful because it shows strong buying pressure as the market continues to make higher lows against a resistance level. Once price breaks out, it often signals a continuation of the existing trend. On its own, this pattern is a solid strategy. But when combined with SMC, it’s like adding fuel to the fire; your accuracy and profitability increase dramatically.

According to backtesting results and market data, the Ascending Triangle chart pattern maintains a high win rate despite its simplicity. Many professional traders rely on it to catch trend continuation trades after a brief consolidation.

Smart Money Concept (SMC)

The Smart Money Concept is a modern trading approach that focuses on tracking the footprints of institutional traders, often referred to as “smart money.” Instead of following retail trading signals, SMC looks at institutional reference points such as:

- Order Blocks

- Fair Value Gaps (FVGs)

- ICT Breakaway Gaps

- Liquidity Grabs or Sweeps

By learning how institutional players operate, you’ll gain insight into where the market is likely to move. This allows you to make precise entries, set effective stop-loss (SL) levels, and optimize your take-profit (TP) targets with confidence. If you are new to SMC, you can start our free masterclass to gain full knowledge of how it works.

Why Combine the Ascending Triangle with SMC?

In simple terms: to boost accuracy and profitability.

While the Ascending Triangle gives you a clear structure for spotting trend continuation setups, SMC helps you filter out false signals and pinpoint high-probability entry zones. With SMC, you can also:

- Detect inducements (fake moves designed to trap retail traders).

- Identify when the real move begins.

- Protect yourself from institutional stop-hunts.

- Place more accurate SL and TP levels.

Since institutional traders often target retail stop-losses for liquidity, knowing what they’re doing will give you a huge advantage. This combination empowers you to trade in alignment with the market makers, not against them.

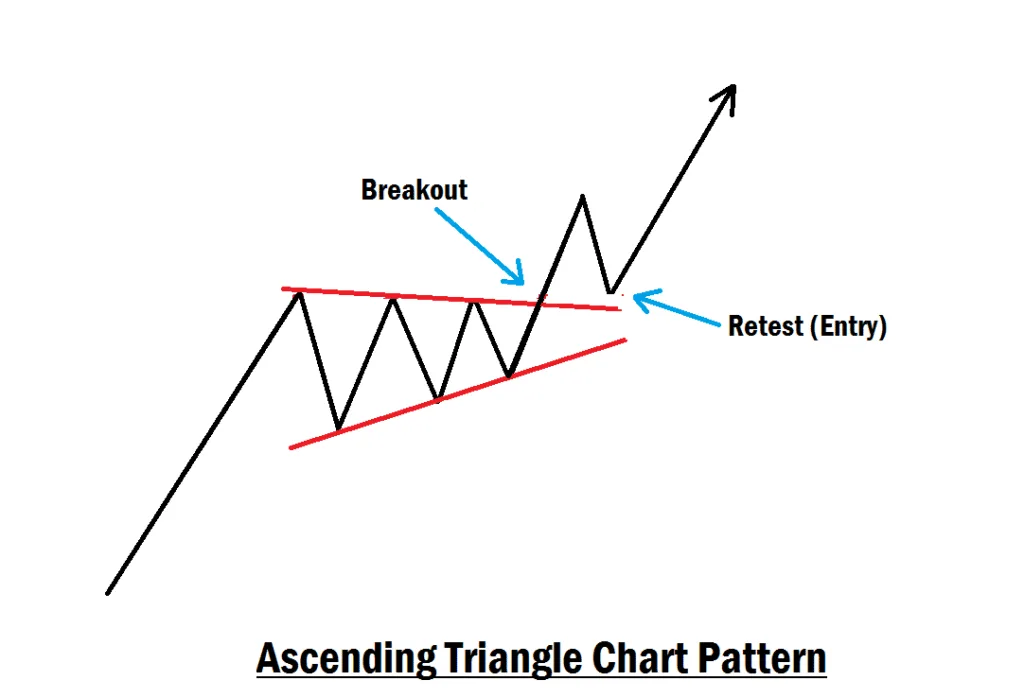

What Is an Ascending Triangle Chart Pattern?

The Ascending Triangle is a bullish continuation pattern that forms when:

- The market keeps creating higher lows (showing buyers are stepping in).

- Price struggles to break a horizontal resistance level at the top.

This creates a triangular structure where buyers are putting more pressure each time price retests resistance. Eventually, the resistance gives way, leading to a breakout to the upside.

Key Features:

- Flat resistance line at the top.

- Rising trendline of higher lows at the bottom.

- Breakout usually happens in the direction of the prevailing trend.

Why Beginners Love the Ascending Triangle

- Simplicity → It’s easy to spot and understand.

- Trend Continuation → Works well during ongoing bullish moves.

- High Probability → When confirmed with volume or SMC, it has a strong win rate.

But here’s the catch: not every breakout is real. Institutions often trigger fakeouts to trap retail traders. That’s where Smart Money Concept comes in.

How Smart Money Concept (SMC) Improves Ascending Triangle Trading

Smart Money Concepts allows you to trade with the institutions instead of against them. By understanding their footprints, you’ll know when a breakout is real and where to place precise entries, stop-losses, and take-profits. You can think of institutional traders as giant freight ships creating waves in the market, displacing the smaller boats, which are the retail traders. Like drafting behind a large truck on the highway, following these movements ensures you catch the real breakout and know where to place precise entries, stop-losses, and take-profits.

Here are the key SMC tools you can use with the Ascending Triangle:

- ICT Breakaway Gap → Confirms momentum during breakout.

- Fair Value Gap (FVG) → Acts as a high-probability entry zone on retest.

- Order Block → Shows the institutional footprint behind the move.

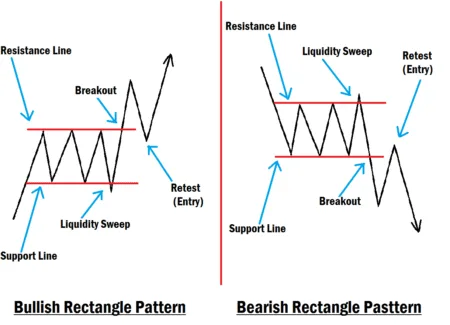

- Liquidity Sweep/Grab → Detects fakeouts before the real breakout.

Step-by-Step Guide: How to Trade the Ascending Triangle with SMC

Step 1: Identify the Pattern

Spot an Ascending Triangle by marking a flat resistance zone and a rising support trendline. Confirm that the market is in an uptrend for higher accuracy.

Step 2: Wait for the Breakout

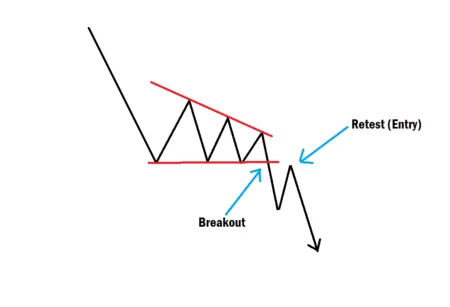

Do not enter the trade at the first breakout candle. Institutions often create false moves to sweep liquidity. Wait for confirmation.

Step 3: Use Liquidity Sweep as a Filter

If price briefly fakes above resistance and pulls back, this is often a liquidity grab. The real breakout usually follows after liquidity is swept.

Step 4: Confirm the Breakout With SMC Reference Points

- After the breakout, look for an ICT breakaway gap (a sudden, strong move showing institutional momentum). If there is no ICT breakaway gap, look for FVG. A valid breakout must show momentum, leaving an imbalance (FVG or ICT breakaway gap).

- Identify any nearby order block, which is the last bearish candlestick before the breakout.

- Mark the fair value gap (FVG) or ICT breakaway gap. They often act as magnets for price during a retest.

Step 5: Enter on the Retest

When price pulls back to retest the broken resistance:

- The ICt breakaway gap or FVG is your entry zone.

- Place your stop-loss (SL) below the order block or structure low.

- Set your take-profit (TP) at the next key resistance or measured move target. You can also target two to three times the size of your stop-loss for easy exit.

Example of an SMC-Backed Ascending Triangle Setup

- Pattern forms with clear resistance and higher lows.

- Price breaks out and comes back to retest.

- Retest aligns with a bullish order block and fills the ICT breakaway gap.

- Entry placed at the ICT breakaway gap → SL below the last higher low → TP is three times the size of the SL.

This setup provides a high-probability entry, eliminating the need to chase the breakout blindly.

Pro Tips for Beginners

- Be patient → Most profits come from retests, not from chasing the first breakout candle.

- Use multiple confirmations → Combine liquidity sweeps, FVGs, and order blocks for higher accuracy.

- Risk management is key → No strategy wins 100% of the time. Stick to proper SL and risk-reward ratios.

- Demo first → If you can’t make it work on the demo, don’t risk your real capital yet.

Important Reminder for Beginners

If you are just starting in forex trading, remember that no strategy works 100% of the time. Forex trading is built on probabilities, not certainties. Rather than seeing uncertainty as a weakness, consider it an advantage. Because outcomes are uncertain, discipline and probabilistic thinking are your edge. Embracing this mindset allows you to execute your trading plan consistently, giving you the ability to adapt and thrive in ever-changing market conditions.

- Always practice with a demo account before trading live.

- If you can’t remain profitable in demo, don’t rush to trade with real money.

- Treat forex like a business. Learn, practice, and master before you invest your hard-earned capital.

With consistency and patience, combining the Ascending Triangle chart pattern with Smart Money Concepts can become a highly effective strategy for your trading journey.

Final Thoughts

The Ascending Triangle chart pattern is one of the best tools a beginner can learn in forex trading. On its own, it already works well as a continuation strategy. But when you combine it with Smart Money Concepts like ICT Breakaway Gaps, Fair Value Gaps, Order Blocks, and Liquidity Sweeps, you take your trading to a whole new level.

This combination helps you filter out fakeouts, enter with precision, and trade in line with institutional flows, the same way professional traders do.

If you master this approach, you’ll no longer just trade breakouts blindly. Instead, you’ll trade with confidence, accuracy, and a clear plan for every setup. If you have more questions, do let us know in the comments section. Trade smartly!