Combining the Ascending Scallop Chart Pattern with Smart Money Concepts (SMC)

In forex trading, chart patterns and Smart Money Concept (SMC) models are two of the most effective tools that traders use to gain an edge in the market. One chart pattern that many traders often overlook but can be very powerful is the Ascending Scallop Chart Pattern.

However, one of the biggest challenges retail traders face when using this chart pattern is not knowing where to enter a trade. This is where Smart Money Concepts (SMC) comes in, playing a crucial role in refining entries.

Smart Money Concepts (SMC) enhance your trading entries. Use entry models like Fair Value Gaps (FVGs), Order Blocks (OBs), and ICT Breakaway Gaps. This approach helps beginners trade retests after breakouts. By refining your entries, you can avoid being stopped out by institutional players.

This guide will explain everything a beginner trader needs to know about the Ascending Scallop chart pattern and how to apply SMC concepts for high-probability trade entries.

Ascending Scallop Chart Pattern Performance

According to backtesting data and track records shared by professional traders, the Ascending Scallop chart pattern has a strong win rate, enabling traders to catch quality trend continuation setups. In a study involving 200 back-tested trades, the win rate averaged 63%, making it a powerful standalone trading strategy that even beginners can use to identify profitable trades.

But here’s the problem: many beginners struggle to find the right entry point without being stopped out by institutional traders. That’s why combining the Ascending Scallop with SMC gives you a refined edge, helping you enter with confidence and avoid unnecessary losses.

Introduction to Smart Money Concepts (SMC)

If you’re new to trading, you may be asking: What is the Smart Money Concept?

Smart Money Concept (SMC) is a trading model that focuses on understanding and following the footprints of institutional traders, commonly referred to as “smart money.” These big players move the market with massive orders that require liquidity (stop-losses and pending orders from retail traders) to get filled.

Because of this, institutions often push price toward areas where retail traders place their stop-losses or pending orders. This is known as a liquidity grab or sweep. By learning how to read and align with these moves, you can avoid being caught in traps that cause most retail traders to lose money.

SMC has proven its effectiveness with a consistently high win rate, making it a must-learn trading approach. If you’re new or still struggling with it, consider starting with our free structured masterclass to fully understand how it works.

Why Combine the Ascending Scallop Pattern with SMC?

The answer is simple: precision.

Instead of guessing your entries, combining the Ascending Scallop chart pattern with SMC gives you:

- Clear direction of price movement from the pattern.

- Refined entry zones using SMC tools like Fair Value Gaps (FVGs), Order Blocks (OBs), ICT Breakaway Gaps, and liquidity sweeps.

Most beginners lose trades because they enter too early or too late. By applying SMC, you’ll know exactly where to look for high-probability entry points. This helps you reduce losses, maximize profits, and trade with more confidence.

In the long run, this combination keeps you from being stopped out frequently by institutional players and allows you to grow your profitability steadily.

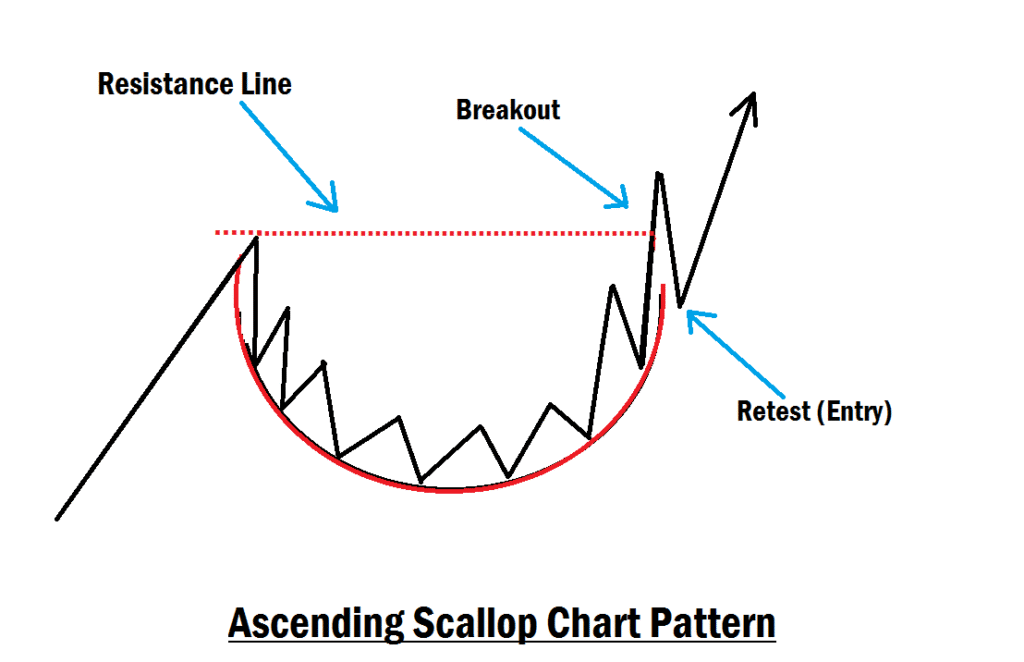

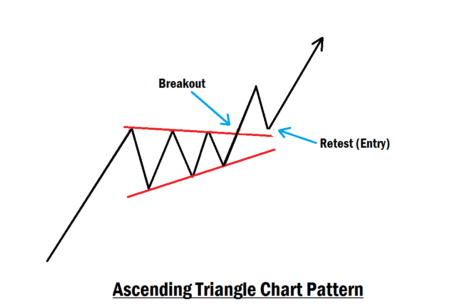

What Is the Ascending Scallop Chart Pattern?

The Ascending Scallop is a bullish continuation chart pattern that typically appears during an uptrend. It forms when the market makes a strong bullish move, then pulls back slightly in a curved, “scallop-like” shape before resuming the upward trend.

Key features of the pattern:

- Appears during an uptrend.

- Shows a curved pullback (like a scallop shell).

- Breaks out in the direction of the trend (upward).

For beginners, this pattern is valuable because it clearly indicates that buyers (bulls) remain in control, and the market is likely to continue upward after the pullback.

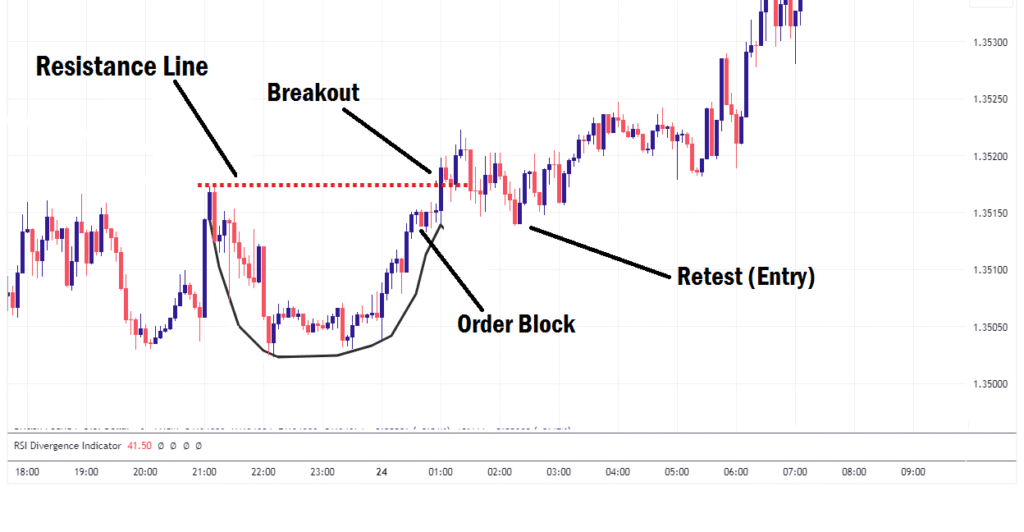

The Breakout and Retest Strategy

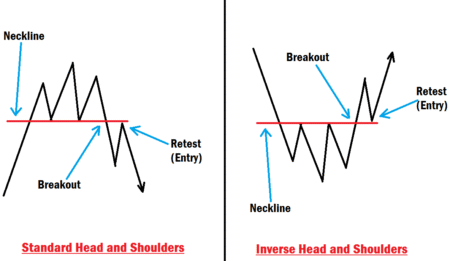

The most effective way to trade the Ascending Scallop is to wait for a breakout above the resistance of the pattern. However, professional traders know that breakouts often retest before continuing.

This is where beginners usually struggle:

- Entering too early leads to false breakouts.

- Entering too late reduces profit potential.

The solution is to trade the retest after the breakout using Smart Money Concepts (SMC).

How to Combine the Ascending Scallop Chart Pattern with SMC Entry Models

1. Fair Value Gaps (FVGs)

A Fair Value Gap occurs when price moves quickly, leaving behind an imbalance between buyers and sellers.

- After the Ascending Scallop breakout, look for a bullish FVG near the retest zone.

- Enter long (Buy) trades when price revisits and respects this FVG.

2. Order Blocks (OBs)

An Order Block is the last bullish or bearish candle before a strong move. Institutions often return to these levels to fill unexecuted orders.

- Identify a bullish OB near the breakout zone of the Ascending Scallop.

- During the retest, if price respects this OB, it signals institutional buying interest.

3. ICT Breakaway Gaps

An ICT Breakaway Gap occurs when price breaks out aggressively, leaving behind an empty price gap.

- If the breakout from the Ascending Scallop creates a gap, expect price to revisit it.

- A bullish reaction from the gap confirms the continuation of the uptrend.

By combining the chart pattern with these institutional reference points, beginners can filter out false breakouts and enter with higher accuracy.

Step-by-Step Guide to Trading the Retest

- Identify the Ascending Scallop pattern during an uptrend.

- Wait for the breakout above resistance (avoid entering immediately).

- Mark SMC zones such as FVGs, Order Blocks, or Breakaway Gaps near the breakout level.

- Wait for price to retest one of these zones.

- Enter long with your stop-loss below the SMC zone (Order block).

- Target new highs or use risk-to-reward ratios like 1:2 or 1:3.

Risk Management for Beginners

Even with a strong strategy, trading carries risk. Keep these rules in mind:

- Never risk more than 1–2% of your account per trade.

- Always place your stop-loss below the retest zone.

- Use a demo account to practice before going live.

Note for Beginners

It’s important to understand that no trading strategy is a holy grail. Nothing works 100% of the time in financial markets. Trading is a game of probabilities and carries high risk.

That’s why you must:

- Practice and master the strategy on a demo account before making any investment plan.

- Develop your personal trading skills because trading requires skills.

- Only go live with real money once you’re consistently profitable in practice.

Remember, if you can’t profit in demo trading, you won’t profit in the live market with your hard-earned money.

Final Thoughts

The Ascending Scallop Chart Pattern is a reliable continuation pattern that provides traders with a clear indication of market direction. By combining it with Smart Money Concept entry models, such as FVGs, Order Blocks, and ICT Breakaway Gaps, beginners can refine their entries during retests, avoid false breakouts, and trade with institutional precision.

Always remember: there is no holy grail in trading. Success comes from practice, discipline, and proper risk management. If you have more questions on this topic, don’t hesitate to let us know in the comments section. Trade with discipline, not deep feelings!