Understanding the ADP Non-Farm Employment Change Economic News Report as a Beginner in Trading

The ADP National Employment change Report is one of the most influential economic indicators in the market. Investors pay close attention to it because it reveals a country’s employment strength and economic health. This matters since no investor wants to support a currency backed by a weakening economy.

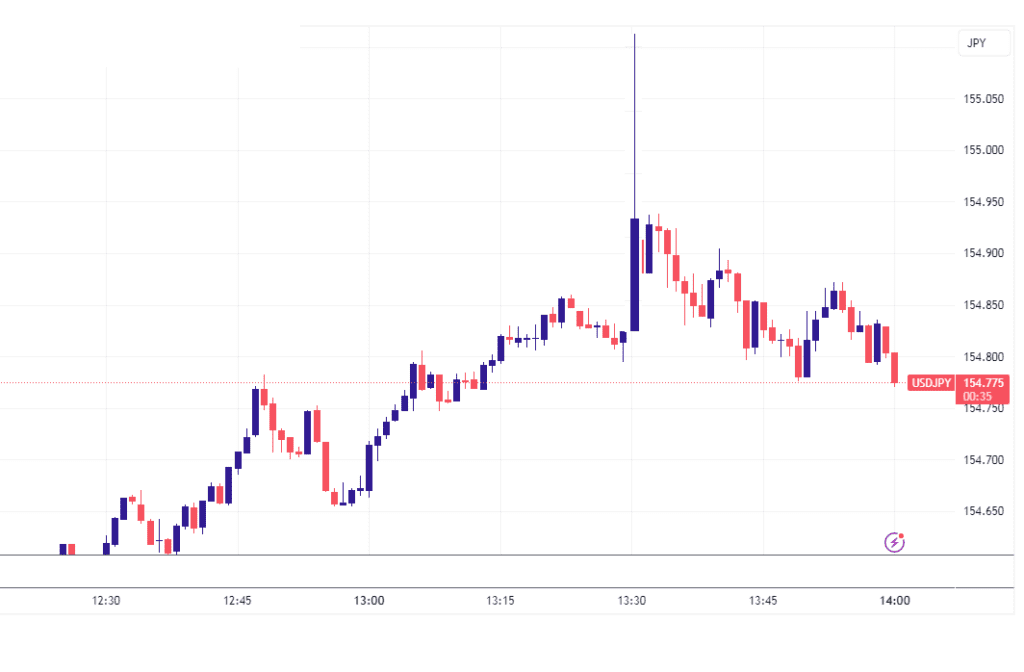

As a beginner trader, you must pay close attention to what large institutions are reacting to because their decisions move the market, not retail traders. Imagine placing a buy position on EUR/USD, only to return minutes later and find the price has spiked violently against you, even hitting your stop-loss with slippage. That type of extreme movement is often triggered by powerful economic events such as the ADP National Employment Report.

If you want to survive and grow in forex trading, understanding this report is essential.

What Is the ADP National Employment Change Report?

The ADP National Employment change Report, produced by the payroll processing company ADP (Automatic Data Processing), measures the monthly change in non-farm private-sector employment in the United States.

In simple terms:

It tells the market how many private jobs were added (or lost) in the U.S. within a month.

Because employment is one of the strongest indicators of economic performance, this report plays a huge role in shaping market sentiment around the U.S. dollar (USD).

Why the ADP Report Matters in Forex Trading

The ADP employment data has a powerful impact on the forex market because:

- Job growth signals strong economic expansion.

- Weak employment indicates slower economic activity.

- Employment trends influence consumer spending, which drives economic growth.

- The report is used by investors as a predictor for the more important Non-Farm Payroll (NFP) report.

When ADP numbers significantly beat or miss expectations, the market often reacts instantly.

How the Market Reacts to ADP Data

The reaction depends on whether the released data is higher or lower than the previous figure or forecast.

If ADP Employment Numbers Increase (Higher Than Previous)

This typically means:

- Strong job growth

- Healthy economic momentum

- Higher confidence in the USD

Impact:

The U.S. dollar usually strengthens, meaning USD pairs may move sharply in favour of the dollar.

The U.S. dollar usually strengthens, meaning USD pairs may move sharply in favour of the dollar.

If ADP Employment Numbers Decrease (Lower Than Previous)

This indicates:

- Slowing job creation

- Weakening economic conditions

Impact:

The U.S. dollar may drop in value, causing sudden volatility in USD currency pairs.

The U.S. dollar may drop in value, causing sudden volatility in USD currency pairs.

⚠️ Why ADP Causes Sharp Price Spikes

ADP ranks among the top high-impact news events. Investors and major players reposition when it is released. Such reports spark:

- Rapid price movements

- Liquidity drops

- Slippage at entry and exit levels

- Unpredictable candle spikes

For beginners who are over-leveraged or trading without proper stop-loss placement, this can cause complete account wipeouts within seconds.

This is why it’s extremely important to check the economic calendar before entering any trade.

ADP Data Release Schedule

The ADP National Employment Report is released:

- Monthly

- Usually on the Wednesday before NFP

- At 8:15 AM Eastern Time (ET)

Always confirm the release time using a reliable economic calendar like Forex Factory.

Should You Trade ADP as a Beginner?

No.

There is no reliable strategy specifically designed for trading ADP news. The market’s reaction can be extremely unpredictable, and prices may move in any direction at high speed.

For beginners, the safest approach is:

Stay away from the market during the ADP release and wait for the volatility to settle.

Your priority should always be capital preservation, not gambling on unpredictable price spikes.

Important Risk Warning

Forex trading carries significant risk and is not suitable for everyone.

As a beginner:

As a beginner:

- Do not trade with real money until you master your strategy on a demo account.

- Use proper risk management at all times.

- No trading strategy works 100% of the time.

- Protect your capital, that is your only weapon in the market.

Once your foundations are strong, your confidence and consistency will naturally follow.

Frequently Asked Questions (FAQs)

1. What is the ADP National Employment Report in forex trading?

It is a high-impact U.S. employment report that measures monthly changes in private-sector jobs. It strongly influences USD currency pairs.

2. Why does ADP affect the forex market?

Because employment numbers reflect economic health. A strong job report boosts the USD, while a weak report weakens it.

3. Is ADP the same as NFP?

No. ADP measures private-sector jobs only, while NFP measures total non-farm employment, including government jobs. However, ADP is often seen as a preview of NFP.

4. What happens when ADP numbers are higher than expected?

The USD usually strengthens, and USD-related pairs may move sharply.

5. Should I trade during ADP as a beginner?

No. The market becomes extremely volatile, and beginner accounts are very vulnerable to slippage and sudden price spikes.

6. How can I stay safe during ADP news?

Use an economic calendar, avoid trading during release time, and wait for the volatility to calm before entering any positions.

If you have further questions concerning this topic, do let us know in the comments section. Always check the economic calendar before placing any trade on any currency pair!