Mastering the ICT Trade Entry Strategies in Forex Trading

In this session, we’ll delve into mastering ICT Trade Entry Strategies in Forex, an essential skill that distinguishes professional traders from those who struggle.

Trade entry strategies, often referred to as entry models, are a vital part of trading success. Many forex traders get confused when it comes to finding the right trade entry, and that’s where a strong understanding of ICT (Inner Circle Trader) entry models becomes a game-changer.

As a Smart Money Concept (SMC) trader, there are specific high-probability ICT entry models you must know and master. These models become even more powerful when spotted within the PD Array (Premium and Discount Array).

Why Strategic Trade Entry Matters

In forex trading, nothing is guaranteed; every decision must be made with a strategic approach. The higher the probability of your trade setup, the more confidence you will have in executing it. And confidence kills emotional trading, which is one of the biggest causes of losses in the market.

Forex trading is inherently risky due to its uncertainties. That’s why it’s critical to master your skills on a demo account before trading with real money.

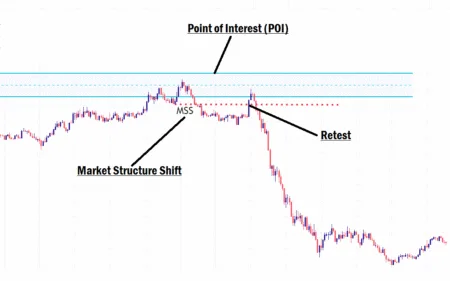

While identifying a Point of Interest (POI) is important, knowing whether that POI is likely to hold is even more important. Certain price behaviors at your Area of Interest (AOI) can boost your confidence in taking a trade.

If you’re not familiar with the PD Array, check the previous lesson for a complete breakdown.

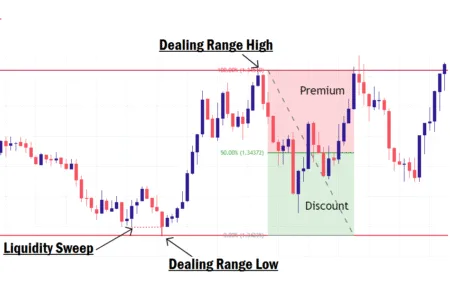

Area of Interest (AOI) vs. Point of Interest (POI)

Area of Interest (AOI):

The AOI is the zone where you expect price to retrace into before searching for a specific POI.

The AOI is the zone where you expect price to retrace into before searching for a specific POI.

- In a bullish price range, your AOI is in the discount zone, below the 50% level of your Fibonacci retracement.

- In a bearish price range, your AOI is in the premium zone, above the 50% level of your Fibonacci retracement.

Point of Interest (POI):

The POI is the exact price level inside the AOI where you expect the market to react. This is the precise spot you watch for trade execution.

The POI is the exact price level inside the AOI where you expect the market to react. This is the precise spot you watch for trade execution.

What is an ICT Entry Model in Forex?

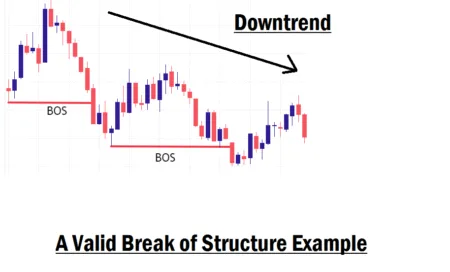

An ICT entry model is a strategic framework that defines when and how to enter a trade inside the PD Array. When any of these models form within the PD Array, they present a high-probability trading opportunity.

The Top 3 Smart Money Concept Entry Models:

- Unicorn Entry Model

- Balanced Price Range (BPR) Entry Model

- FVG and Order Block Entry Model

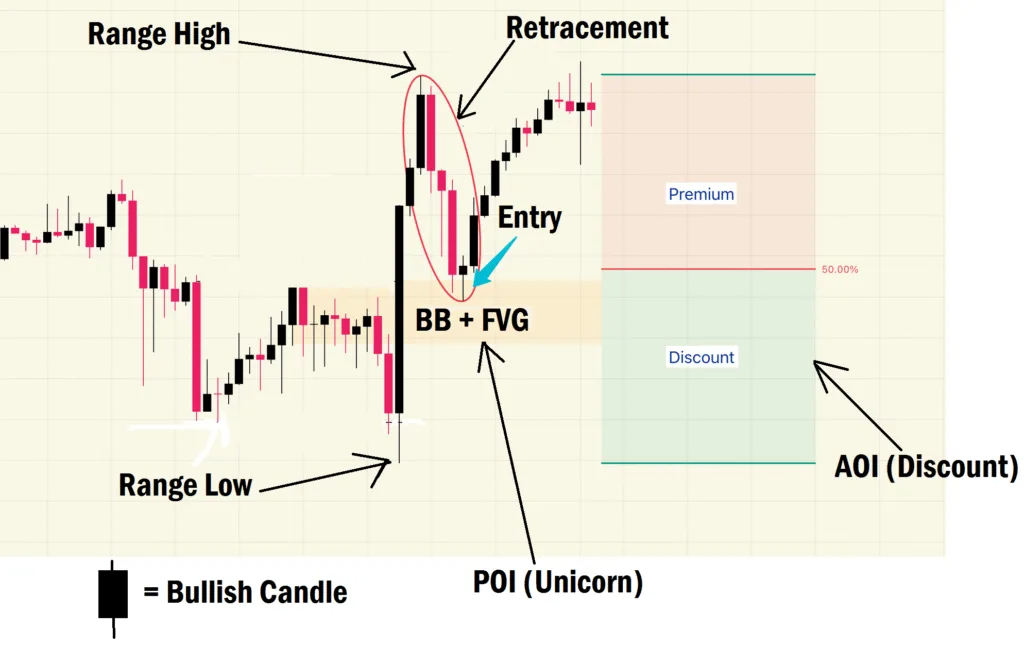

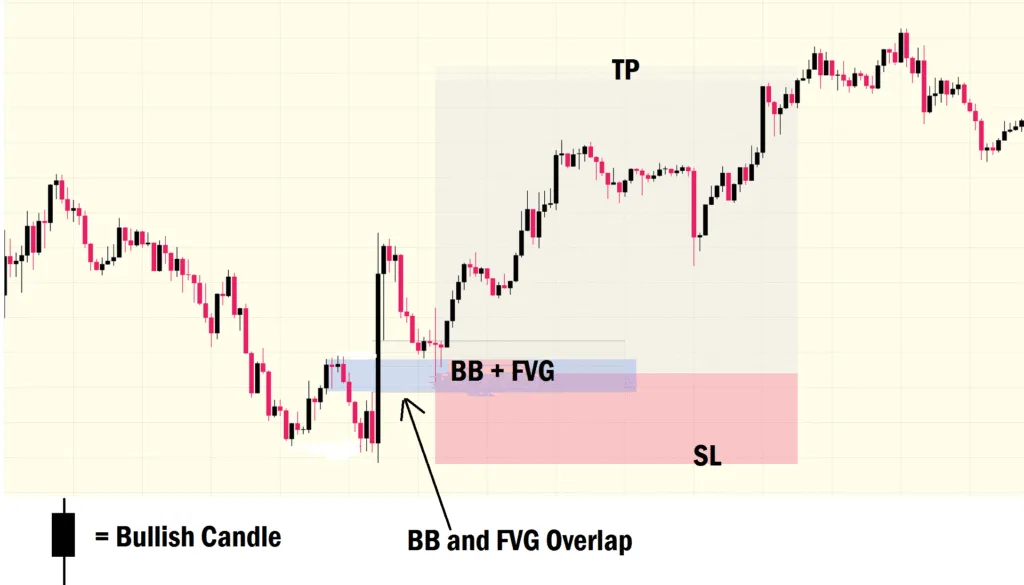

1. Unicorn Entry Model

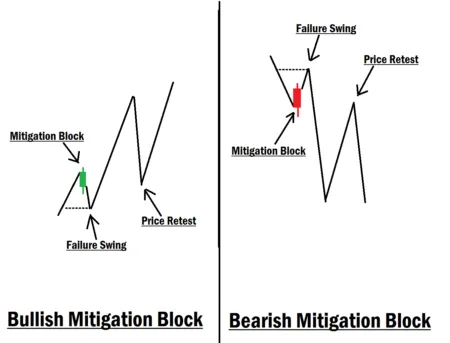

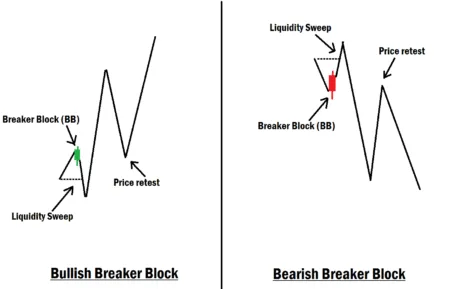

A Unicorn Setup forms when a Breaker Block (BB) or Mitigation Block (MB) aligns with a Fair Value Gap (FVG) inside your AOI.

- AOI: Premium or discount area (depending on market direction).

- POI: The confluence of BB or MB with an FVG (the “unicorn”).

- Stop Loss (SL): Below the swing low/high created by the BB or MB.

- Take Profit (TP): The swing high/low of the price range.

This is one of the most reliable setups when executed correctly. See a bullish trade example below.

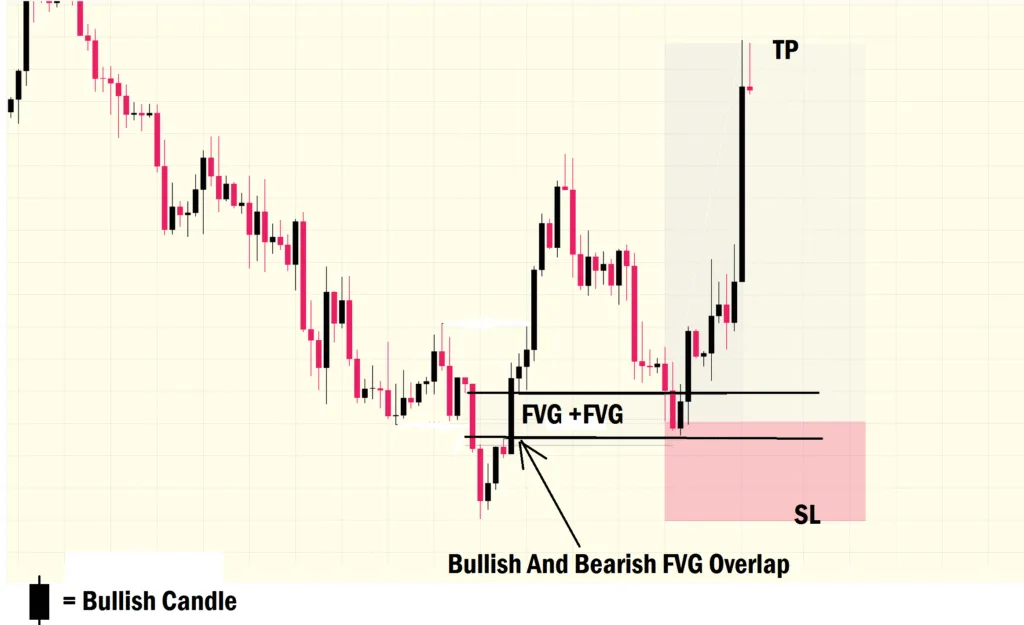

2. Balanced Price Range (BPR) Entry Model

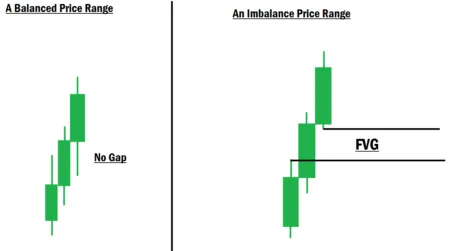

The BPR setup occurs when two FVGs overlap from opposite directions.

- Look for a bearish and bullish FVG overlapping within your AOI.

- The midpoint of the overlap becomes your entry zone.

- SL: Below the swing created by the two FVGs.

- TP: The range high/low depending on the direction.

BPR setups often signal strong reversals or continuations of the existing trend. See the bullish trade example below.

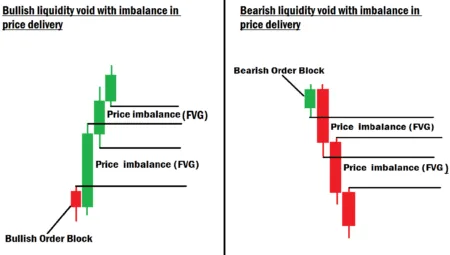

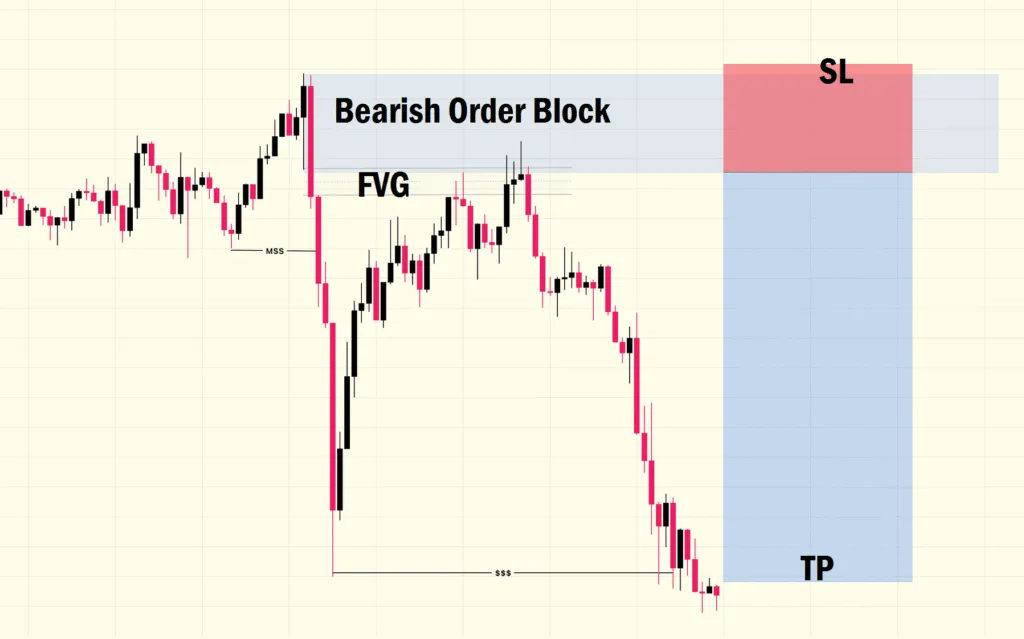

3. FVG and Order Block Entry Model

This is one of the most powerful confluences in ICT trading.

- Look for an Order Block closely aligned with an FVG inside your AOI.

- Enter the trade once price touches the order block.

- SL: Below the Order Block.

- TP: The swing high/low of the price range.

This model works best in clean, well-defined ranges. See bearish trade example below.

Final Thoughts

These three ICT trade entry models can dramatically improve your trading accuracy when applied in a clear and valid price range. However, remember that no setup works 100% of the time; proper risk management is essential.

Before risking real money, learn, practice, and master these setups on a demo account until they become second nature.

In our next class, we will cover “Old Highs and Lows,” another critical concept for identifying market turning points. See you there!